TALLY ERP9

ACCOUNTS-BASICS

Before entering into Computerised Accounting, let us refresh Manual Accounting. Accounting means the recording of the day today business transactions and preparation of necessary books systematically. The basic Accounting Order will be as given below:

ACCOUNTING SYSTEMS

1. Single Entry Book Keeping System

2. Double Entry Book Keeping System

BASIC ACCOUNTING ORDER

Transaction

Voucher Entry

Ledger

Trial Balance

Final Accounts

~Trading a/c

~ Profit and Loss a/c

~ Balance Sheet.

1. Transaction

An activity in terms of money value is called a Transaction. Transaction means a Financial Activity.

a) ‘Kamal bought a book for Rs.500’ is a transaction.

b) ‘Vijay bought a pen’ is not a transaction.

2. Voucher Entry

From transactions, we prepare the ‘Journal Entries’. Every transaction has minimum two aspects viz. Debit aspect and Credit aspect. Finding the two aspects from a transaction and writing in Journal Format is an important part.

3. Ledger

‘Ledgers’ are prepared from ‘Voucher Entries’. They are useful to view the particulars or balances for a specified period. Ledger has two columns/sides where debit and credit transactions are shown.

4. Trial Balance

Preparing Trial Balance is a year-end process. The Closing balances of all ledgers are entered here. Debit balances of ledgers are written on the debit side of Trial balance and vice versa. After bringing forward of all balances, the Trial Balance should tally. Otherwise, there may be errors in our Ledger Preparation. If the error could not be located in time, the short fall may be transferred to suspense a/c which should be rectified later.

Preparation of Trial Balance

Trial Balance can also be prepared from the closing balances of ledgers using the following rules. Enter all Assets and Expenses on the debit side of the Trial Balance Enter all Liabilities and Incomes on the credit side of the Trial Balance

5. Final Accounts

Trading Account, Profit and Loss Account and Balance Sheet are called Final Accounts. As these are prepared at the final end of a year they are called Final accounts. By preparing Trading Account, we find the Gross Profit or Loss and by Profit and Loss Account, the Net Profit or Loss is arrived.

JOURNALISING TRANSACTIONS

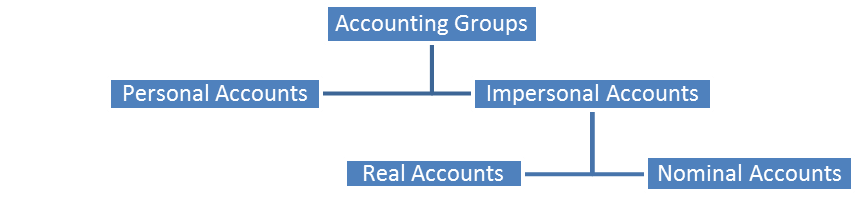

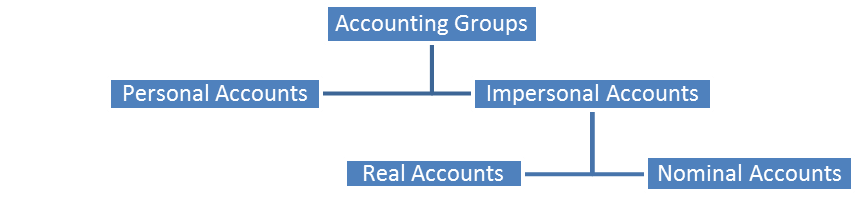

There are three basic Accounting Groups viz.

(a) Personal Accounts

(b) Real Accounts

(c) Nominal Accounts

This can alternatively be classified as follows:

Personal Accounts

Ledger Accounts related to individuals, Firms, Companies etc., are called personal Accounts.

For example: Bhavani’s A/c, Indian Airlines A/c.

Real Accounts

The Accounts related to the things really existing, which can be seen or touched are called Real Accounts.

For example: Machinery A/c, Land and Buildings A/c etc.,

Nominal Accounts

In contrary to the Real Account, Nominal Accounts are not really existing. They are only for name sake and nominal. They cannot be either seen or touched. For example: Salary A/c, Conveyance A/c etc.